Where should you open your next store – and how much will it make? Until recently, answering those questions required deep pockets and consultants. Now, new AI-powered tools are democratising access to location intelligence, giving every operator the power to act on data, not guesswork.

In the Australian market, location intelligence is typically accessed via a mix of consulting services and complementary presentation software. As a result, access to location intelligence to answer such questions has been reserved for those willing to part with large sums for consultants to develop reports and articulate insights and recommendations.

The reality is that many businesses are flying blind with little understanding of how insights will be presented and interpreted, even after investing in the appropriate industry experts.

As the location-intelligence market matures, measures of success are beginning to standardise. Globally, several companies are offering data-driven location intelligence that can be accessed directly online by businesses on a self-service basis. This trend signifies the market’s response to client demands for in-house, easy-to-use, software-supported location-intelligence solutions.

Once again, we are seeing clients speaking out for a shift in the market. Too often have I been told by retail brokers who need a report to support a transaction, or smaller landlords needing insights to secure a new tenant, that they can’t justify the service costs for the standard location-intelligence offerings.

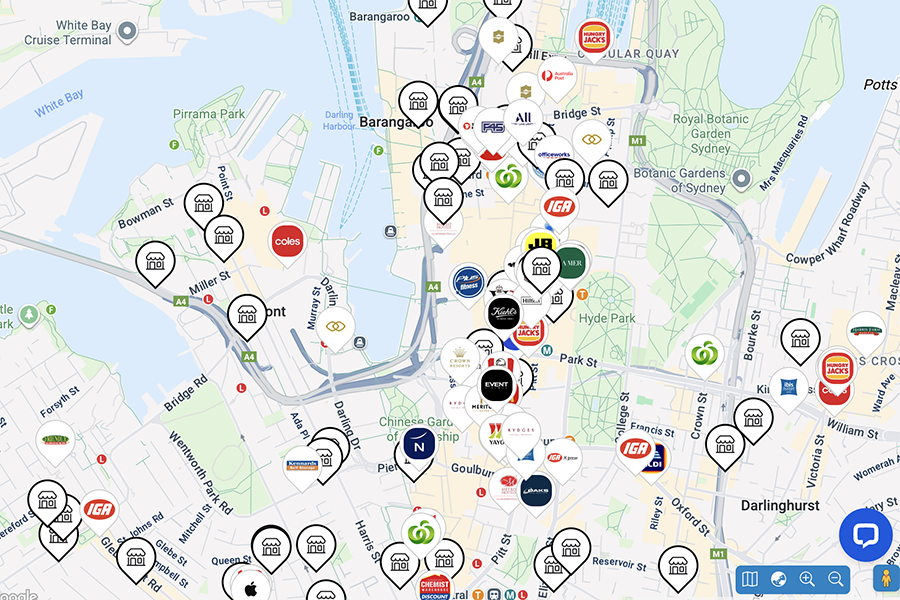

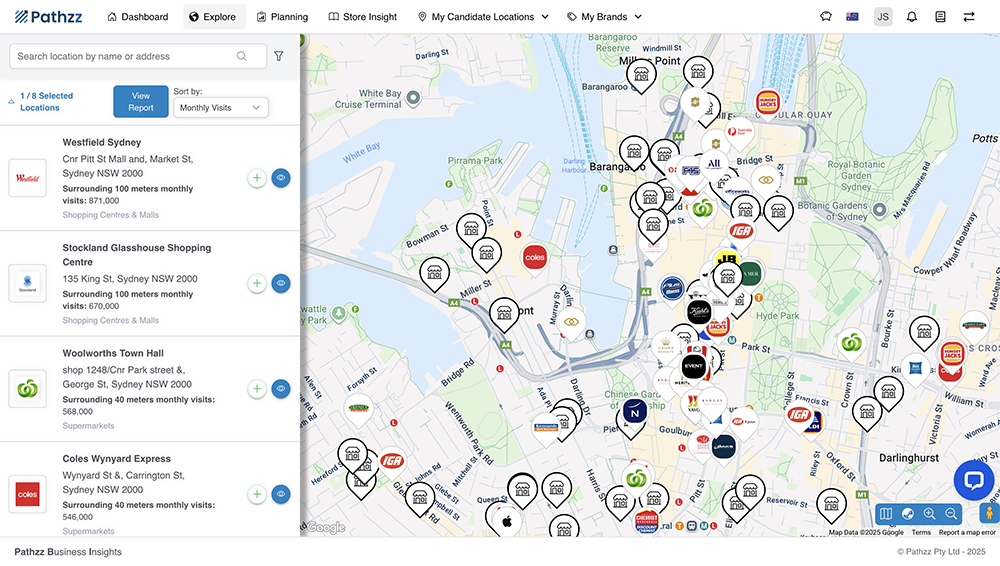

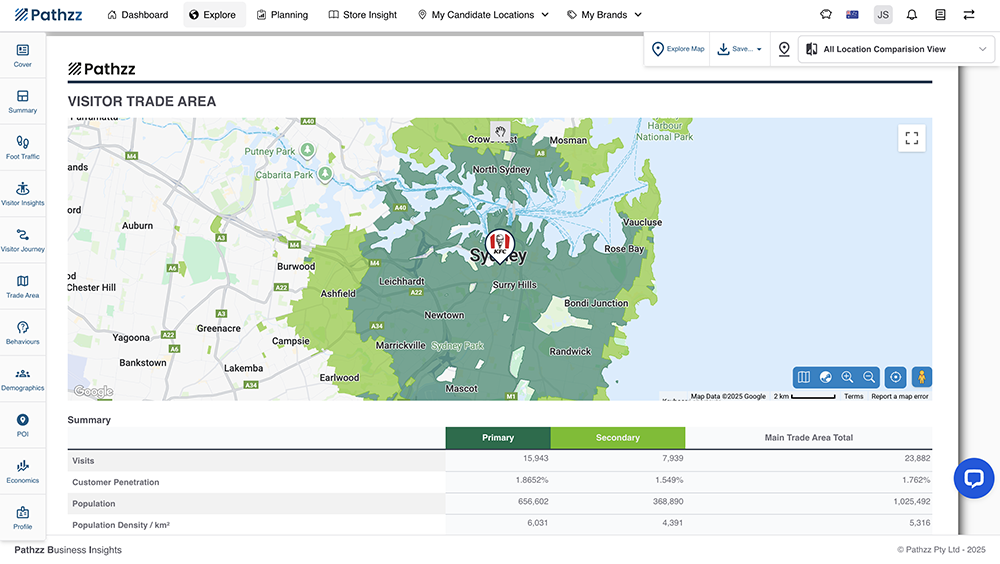

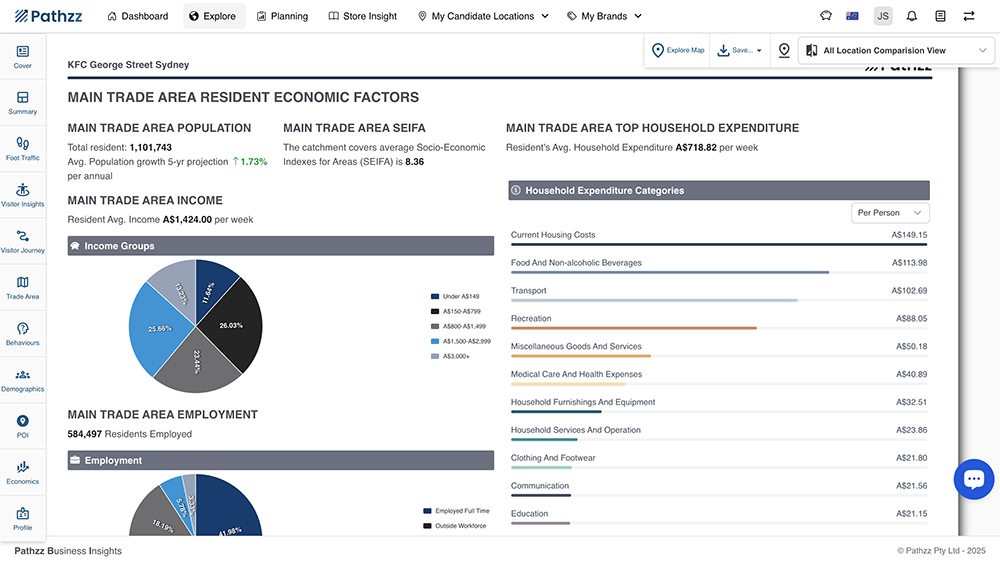

This leads me to the realisation that understanding consumer foot traffic relative to competition, trade areas, cross shopping, demographics, visitor journeys, and forecasted sales (to name a few of the measures of performance), should be a standard to access across all retail locations.

Retail has faced many headwinds over the last five years, and it appears more will follow in the short term. The major changes to consumer behaviour brought about by Covid include higher WFH rates, high inflation, lower visitation to our cities, and a greater demand for delivery services, not to mention the unfolding impact of AI on work, home, consumption and leisure. Such changes are for the most part structural in nature and are unfolding day by day.

All of which is signalling that today and tomorrow are not “business as usual”, rather, we are caught in a phase of development that is characterised by constant change.

Location intelligence suppliers are required to navigate these changes as they unfold. Most importantly, the market demands that location intelligence needs to be accessible to all market participants.

The growing need for location intelligence is reflected by the current (2025) global spend, which is estimated at US$24 billion and is projected to reach US$53 billion by 2030.

One of the key drivers for spending in this category is the introduction of low-cost software platforms that create efficiencies in the delivery of real-time location insights to guide strategic decision-making by both large organisations and SMEs.

In the retail space, there are several key activities that require location intelligence support, such as:

- Leasing – helping match the right tenant with the right store location.

- Acquisition – identifying which assets to acquire that match the high performers in your portfolio or those of competitors (shopping centres, large-format retail etc.).

- Marketing – understanding who your customer is and how to reach them.

- Property management – optimise facilities, tenant relations, customer experiences, legal, finance and marketing to drive investment goals.

We can further break down these business activities into location intelligence activities performed by retail specialists or consultants.

- Site selection – identifying which locations best suit your next store location.

- Performance monitoring/benchmarking – understanding the performance of your locations against the competition.

- Sales forecasting – forecast the potential of new locations to drive sales in real dollars.

- Portfolio optimisation – learn what the key drivers are for successful locations in your portfolio and find more like them.

- Consumer profiles/trade areas – building consumer profiles based on the visitors to store locations and the local trade area (demographics, cross shopping, origin of customer).

- Site diligence for capital markets/valuations – using POI (business address data), development approvals, demographics and more to determine the value of a particular location to an investor/occupier.

To date there hasn’t been much data available on retail locations to support these types of activities. It has been reserved for those firms with research teams with the expertise to create reports using multiple data sources, or through leveraging consulting services, which are bespoke in nature and require a lot of time and co-ordination to gather the insights needed.

The challenge has always been testing, access, costs and time to generate location intelligence for retail business activities.

Given the global trends toward software, automation and AI, here are some considerations to help select the right location intelligence service provider for your business:

- Is open to the business public via a self-service platform.

- Supports free trials to ensure you get a real view of how the data insights can support your business activities.

- Provides real-time, on-demand reporting on locations, complete with visitation (or spending) counts, demographics, visitor journeys, cross shopping and trade areas.

- Provides POI (business address data) and other such information, including approved developments.

- Provides sales forecasting against potential listings/locations.

- Provides a portfolio analysis of the key drivers of high sales and can identify new locations or assets that match those characteristics for network extensions (retailers) or acquisitions (landlords).

- Delivers reports instantly or within a few minutes.

- All the above is automated.

In our experience, a successful location-intelligence solution is something that scales, offering easy and efficient access to data-driven insights to guide decision-making. In today’s world, if you can’t generate location intelligence reports on demand, you will be slow to seize opportunities when you need to – now.

Consulting services will always have their place; however, for standardised outputs, AI is demonstrating it has the ability to create efficiencies at answering once-complex questions, instantly. Consider the impact of ChatGPT on many industries; the use of AI to automate once-manual tasks is here and advancing quickly. Understanding how AI, big data and automation is tackling the challenges of the retail industry is going to be a key theme for creating a competitive advantage in both the short and long term. Since 2020, Pathzz has been at the forefront of using AI and big data to deliver efficient and valuable location intelligence solutions to our clients.

Keeping apprised of the innovations in our industry is a good way to mitigate risk of being left behind in the data and intelligence arms race. If you aren’t thinking this way, your competitors certainly are as they chase higher revenue and profits achieved through efficiencies afforded by data and technology. For Pathzz, the question was and remains, how do we make location intelligence accessible, reliable and valuable to the retail and greater CRE market.

- This article was first published in SCN magazine

Add comment