As investor confidence rebounds globally, Australia’s retail sector is entering a new phase of growth and competition, with Little Guns quickly becoming one of Australia’s most sought-after asset classes.

The SCN Little Guns report comprises shopping centres with a gross lettable area between 20,000sqm and 50,000sqm. This segment of the retail market typically includes sub‑regional shopping centres and some larger neighbourhood centres, usually characterised by a high convenience‑based tenant profile. This asset class is quickly becoming one of the most competitive sub‑sectors of Australian retail property, with growing investor confidence, deepening capital allocations, and strong pricing growth over 2025.

The centre’s balance between convenience retailing (defensive income) and income growth prospects is attracting increased institutional and private investment interest. The resurgence of demand for Australian convenience‑based retail mirrors a broader global trend, one led outside of the US.

Global liquidity and sentiment driving local momentum

For many global markets, the US serves as a catalyst for sentiment and investment activity. Retail trends from the US illustrate this connection clearly, with 1H FY25 transaction volumes across the US sitting 34 per cent above the same period in 2024.

Why M2 Money supply is a barometer for global sentiment

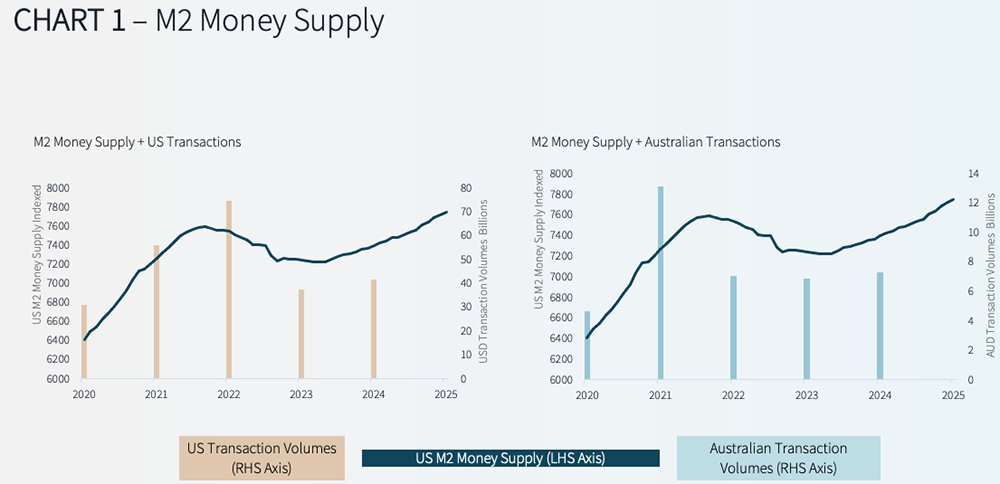

Shifts in the US monetary environment often influence global liquidity and investor sentiment, most clearly measured through the M2 Money Supply, a key barometer for capital deployment worldwide. The Federal Reserve’s M2 measure tracks liquid capital within the US economy, providing insight into monetary conditions and inflation control.

Periods of rising M2 typically signal an expansionary policy environment, lower interest rates and increasing institutional lending capacity. Consequently, a rise in M2 directly correlates with increasing transaction volumes both in the US and Australia. The market is now at a new M2 high as of 2025, signalling that transaction volumes will likely continue to rise.

This dynamic aligns closely with recent retail investment patterns; US transaction volumes reached US$74 billion in 2022, one of the highest annual totals on record.

As US investors seek higher risk‑adjusted returns offshore, capital flows increasingly target markets like Australia. Foreign investment in Australian retail peaked at $2.5 billion during 2021-22. By 2025, with M2 growing at about 5 per cent a year, its fastest pace since 2021-22, foreign capital flows are once again strengthening. Notable transactions such as Keppel’s $525 million stake in Top Ryde earlier this year, reinforce this trend.

History has a tendency to repeat itself, and in this case, rising global liquidity and confidence point to a well‑positioned Australian retail market heading into 2026.

Record occupancy out of the US a mirror between the US and Australia

Price growth has followed, with urban retail centres (equivalent to centres located in metro regions in Australia) recording about 112 per cent capital value growth from 2023-24 and Grocery Anchored Centres about 38 per cent. This momentum has not slowed and has continued into 2025.

Beyond capital market movement, operational metrics are also strengthening. Occupancy rates across the US are just 15 basis points from record highs, with the average retail occupancy rate at 95.7 per cent nationally. Quality retail stock is experiencing the fastest leasing backfill rates in 15 years, further fuelling investor confidence. Near record occupancy has led to continued rental growth throughout the US as year-on-year growth at mid-2025 was at roughly 1.9 per cent.

With the US experiencing strong occupancy growth alongside a strong rental market, we turn to the Australian story on the back of the most recent publication of re-leasing spreads by the Real Estate Investment Trusts.

Australian Real Estate Investment Trusts (REIT) re-leasing spreads highest for over a decade

The REIT reporting season provides a clear window into market performance. FY25 results were particularly strong, with all major retail‑focused groups posting positive re‑leasing spreads, the highest in over a decade, averaging 3.84 per cent.

This marks the fourth consecutive financial year of positive re‑leasing spreads, as the negative reversions experienced through the Covid period are still being unwound, highlighting that, although high levels of growth have been established within the market, there is still extensive rental upside yet to be discovered.

Persistent leasing growth, alongside a notably lower incentive profile relative to the office sector, is reinforcing the attractiveness of retail assets and fuelling sustained investor interest, as stronger fundamentals continue to underpin pricing tension and yield stability that helps the sector re‑establish long‑term market confidence.

Volumes across all Australian retail sub-sectors growing; heightened liquidity and confidence within the sector

The ripple effects of expanding US liquidity are being felt beyond its borders, and Australia is no exception. With capital activity and investor confidence rising in tandem, the local retail sector is emerging as one of the standout beneficiaries of this global upswing.

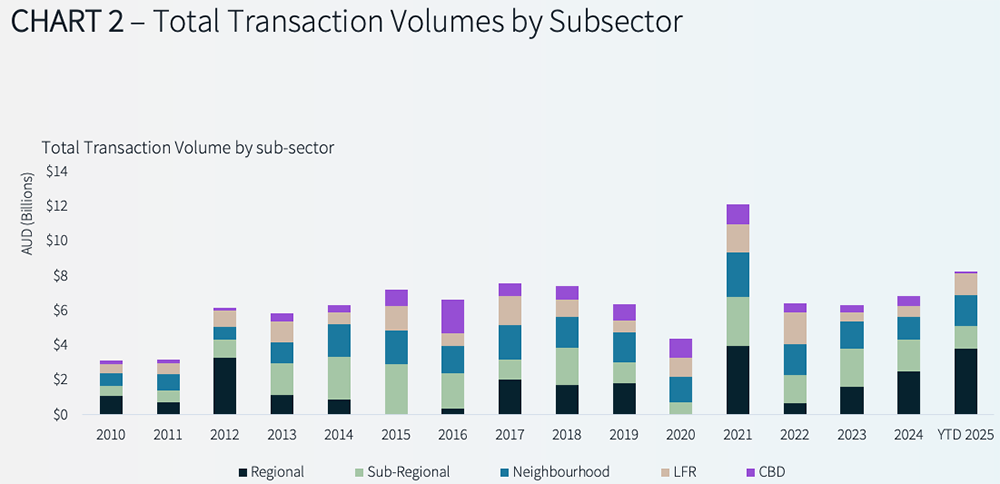

Throughout the year, macro‑economic fundamentals have served as a strong tailwind for retail. Consumer behaviour continues to normalise post‑Covid, underpinning stable trading conditions and renewed institutional interest. By the end of Q3 2025, national retail transaction volumes reached $8 billion, 65 per cent above the same point in 2024 and 159 per cent higher than the same point in 2023.

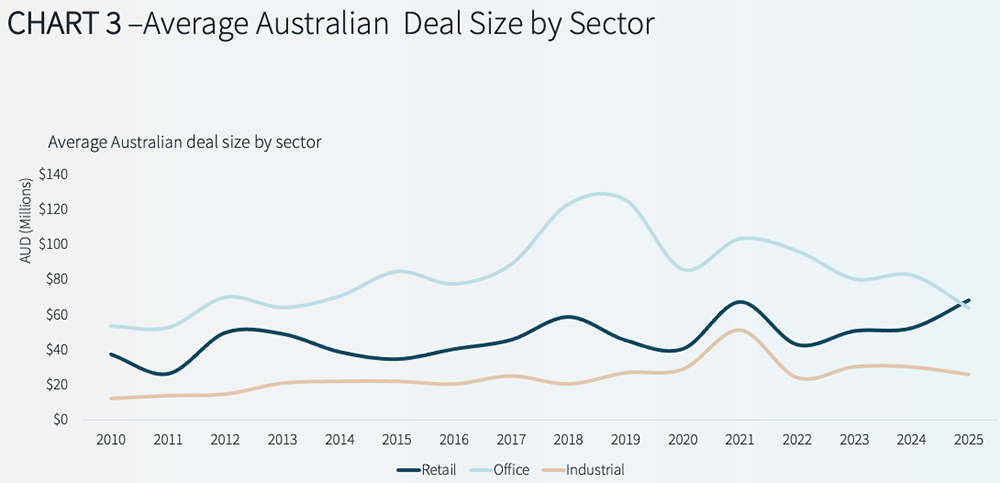

Historically, by Q3 each year, retail transactions have accounted for about 23 per cent of total volumes across the major sectors (office, industrial and retail). This year, retail comprises 40 per cent of all transactions nationally, capturing 17 percentage points of additional market share.

The retail sector, for the first time since at least 2010, holds the largest average deal size of the major asset classes, at $68.1 million, 7 per cent above office and 162 per cent above industrial. This substantial increase in average deal size shows a deepening liquidity for larger shopping centres, partly attributable to new capital sources entering the market. The higher average deal size is also attributed to a rise in Regional Centre transactions over 2024-25 – discussed further in this report.

According to Nick Willis, Executive Director, JLL Retail Investments Australia & New Zealand:

“On transactions over $100 million, we’re witnessing deeper capital demand and stronger competition from groups. Round one average bid numbers are up 38 per cent, year on year, led by a resurgence of institutional, wholesale and offshore mandates targeting the Australian retail sector. The local managers and syndicators have all had substantial growth in their businesses over the past five years and continue to grow their participation in larger regional shopping centres. However, after a period of hiatus and divestments, listed vehicles, wholesale and pooled funds, and offshore capital are acquisitive again. The transaction landscape is continuing to improve globally and we are now seeing early signs of compression again.”

Larger regional centres lead the way for market positivity

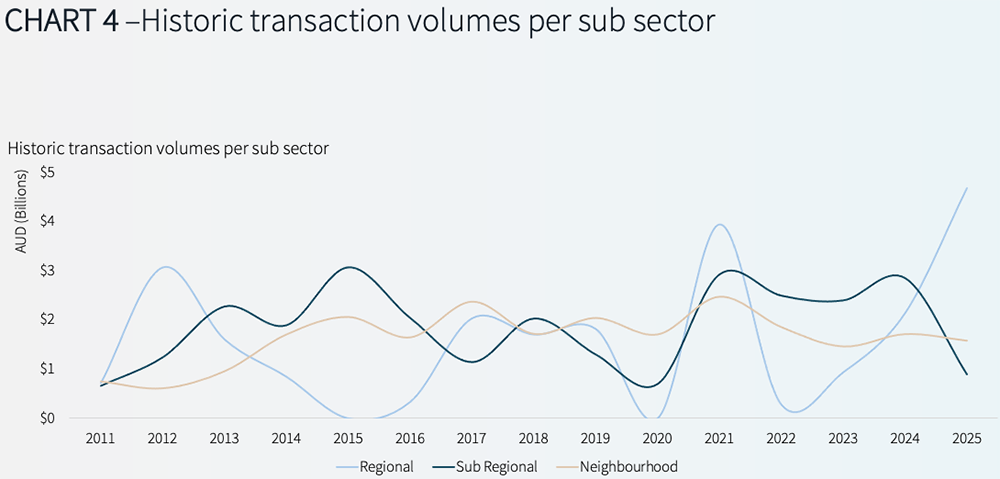

At the top end of the market, regional centres have led the way for sector sentiment and transaction activity. While deal volumes have remained elevated nationally, the composition of sales by subsector has shifted, highlighting a renewed appetite for these traditionally tightly held assets.

This year, landmark regional transactions, including Erina Fair, Top Ryde and Woodgrove, have lifted overall investment volumes, with YTD volumes tracking above full year 2024 volumes. The revitalisation of institutional capital participation within these processes echoes the revitalised conviction in the broader retail sector.

According to Sam Hatcher, Head of Retail, JLL Retail Investment Australia and New Zealand:

“Competition for major regional shopping centres is intensifying, as a growing weight of capital seeks to reweight back towards the sector. This shift in investor sentiment is being buoyed by the performance of the US retail market and is providing the catalyst for many investors to make their first foray into the sector, as evidenced by the sale of Top Ryde, with Keppel REIT making its first shopping centre acquisition globally.”

During 2025, the JLL Retail Investments Australia team has handled the sale of $1.8 billion of regional centres.*

Historically, periods of heightened regional trading have often been followed by quieter years; however, this cycle is different due to the steady annual increases in Regional Centre volumes. This suggests a more sustained recovery may be under way, rather than faster cyclical peak-to-trough movements experienced in prior periods.

After three years as the market’s most liquid subsector, Sub‑Regional Centres have shown a substantial decline in transaction volumes through 2025, down 70 per cent, year to date. Vendors are reluctant to divest from the sub-sector (including larger neighbourhood centres), given robust retailer performance, record occupancy and solid income growth prospects.

This contraction in supply, combined with continued capital allocation toward the sector, is driving pricing tension and yield compression.

Conclusion

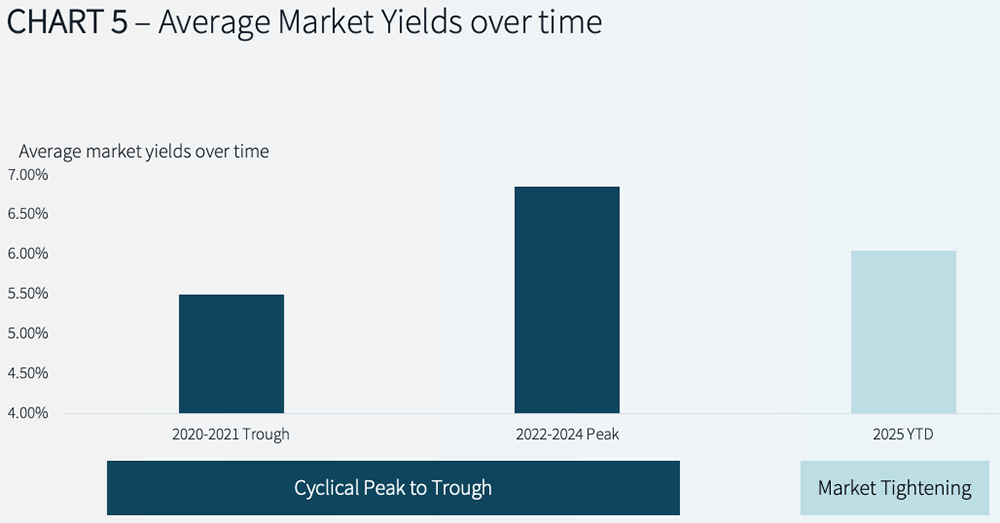

Following several years of repositioning, Australia’s retail investment market has entered a clear expansion phase underpinned by global liquidity, strong leasing performance and renewed institutional confidence. Yields now sit between their 2024 trough and the compression highs of 2021, reflecting disciplined pricing amid deeper capital pools and heightened competition.

Large convenience‑based and regional centres are leading this momentum, supported by sustained occupier strength and robust income growth. Yet, supply remains limited as owners hold assets benefitting from high occupancy and positive rental growth, extending the imbalance between demand and opportunity.

With capital availability continuing to build, this tension is expected to maintain pricing resilience and selective yield compression into 2026, signalling a market defined by confidence, depth and cyclical renewal.

* includes all neighbourhoods & sub-regional shopping centres between 20,000sqm and 50,000sqm | ^as at October

- This article by James Hayward, Senior Analyst, Retail Investment, and Sam Linden, Director, Retail Investments at JLL, was first published in SCN magazine – Little Guns 2025 edition

Add comment