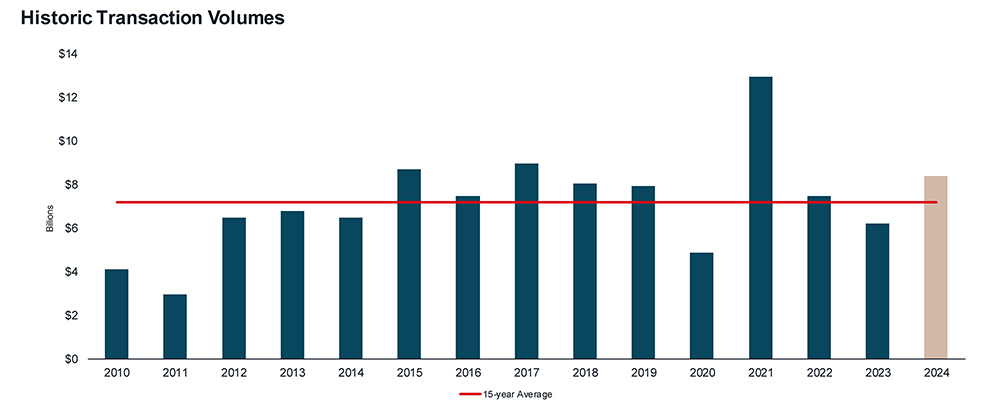

Retail transaction volumes in Australia experienced substantial growth in 2024, finishing 14% above the prior three-year average and 17% above the 15-year average, according to JLL Retail Investments. The total transaction volume reached close to $8.4 billion across 116 transactions, marking the fourth-largest year on record since 2010.

Transaction volumes showed significant variability throughout 2024. The year started slowly, with only 11% of total retail volumes completed in the first quarter, indicating a cautious approach from investors. However, the market saw a dramatic shift in the latter half of the year, with a surge in activity. The third and fourth quarters accounted for the majority of transactions, totalling nearly 75% of the total retail volumes for the year, above the prior three-year average of 64%. This uneven distribution of deal flow illustrates a significant change in investor sentiment and market conditions as the year progressed.

Nick Willis, Senior Director of JLL Retail Investments Australia & New Zealand, said, “During 2024, Australia’s retail market experienced a resurgence in optimism, driven by the renewed interest of local REITs and wholesale funds, following several years of subdued activity. The sector’s improving global narrative, underwritten by strong fundamentals and positive tailwinds, drew in maiden capital and outlined a growing increase in offshore engagement.

“We saw a notable rise in interest from a diverse range of investors. This influx of new market participants intensified competition for quality assets, resulting in a 30% increase in bidder participation across our campaigns. We expect this to continue into 2025, namely offshore funds in this weakened Australian Dollar environment, particularly from US domiciled funds,” said Willis.

“Syndicators solidified their position as the dominant capital source, contributing 40% of all retail transactions. Active managers such as Fawkner acquired more than $1 billion in 2024, securing assets such as Figtree Grove and Willows Shopping Centre. We will continue to see this trend in 2025, however now with more competition from the institutional market.”

The market for retail in 2024 was shaped primarily by a lack of available core assets in metropolitan locations with management control. The persistent shortage of core assets continues to exert pressure on the market, further resulting in predicted yield compression across the sector and increasing the trend of capital partnership to access opportunities in 2025.

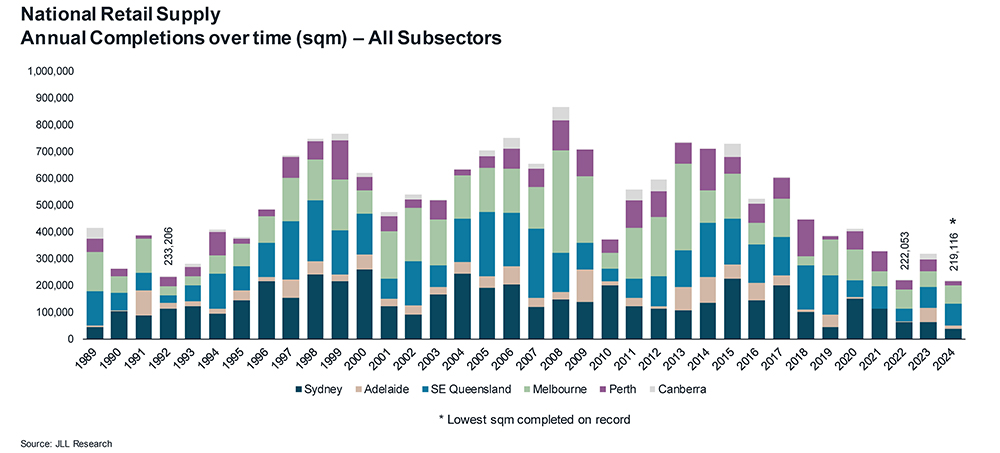

Sam Hatcher, Head of JLL Retail Investments Australia & New Zealand, stated, “The anticipated rental growth story arrived in 2024 with large format retail and sub-regional rents being most pronounced at 4.8% and 3.6% respectively. As a result, owners of existing centres who are experiencing this growth within their portfolios continue to be the most dominant buyers in the market. While newer entrant capital is hovering across the sector and awaiting data sets, that existing owners are experiencing in real time, before deploying. In a supply starved market, we expect rental growth will drive capital engagement leading to more demand and as a result will be the ultimate driver of yield compression in 2025.

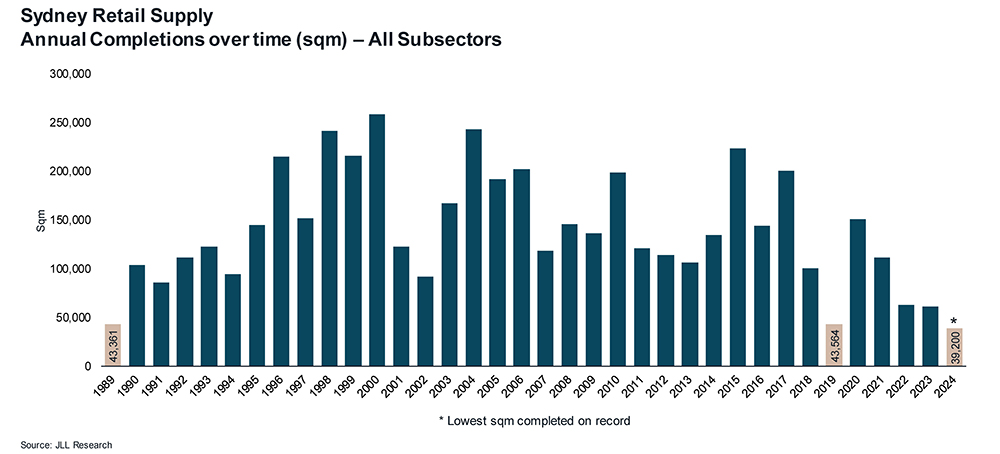

“Exacerbating this is the sheer lack of new built form retail. In Sydney, only 39,200m2 of retail was developed in 2024, the lowest level since 1989. Our analysis across the sub-sectors is that economic rents would have to grow between 20% and 40%, dependant on the asset class, to support new feasible retail development to meet the burgeoning population growth,” said Hatcher.

JLL played a significant role in the market in 2024, advising on 34 retail transactions. Notably, transacting over $619 million worth of retail in the last two months of the 2024 calendar year alone, including significant assets such as Cranbourne Park for $126.5 million.

Add comment